Goodwill Accounting: What It Is, How It Works, How To Calculate

Content

Examples are established distribution systems, reputation, brands, customer loyalty, and expertise in research and development. However, the company did not present them because of the limitations of the accounting method. Negative goodwill arises when an acquirer pays less for an acquiree than the fair value of its assets and liabilities. This situation usually only arises as part of a distressed sale of a business. Businesses are required to calculate goodwill annually to test for impairment, which is caused by the change in a business’s fair market value. Goodwill is equal to the amount between a business’s purchase price and its fair market value, and is usually considered during a business acquisition.

Having been established over years of honest and efficient behavior by the previous owner, it is transferable to the buyer, assuming the buyer maintains the pre-established excellent business practices. According to ssr.com, if it is determined that any exists, total goodwill may be separated into personal and enterprise components. In order to determine whether it is attributable to that of an enterprise or a particular person, an investigation into its source is required. According to the IFRS Standards, businesses shouldn’t amortise goodwill. Instead, it’s the business’s responsibility to monitor the value of goodwill and apply impairment when necessary. For example, company A bought company B for Rp2.5 billion, total assets of company B amounted to Rp3.5 billion and total liabilities of Rp1.5 billion.

Look up a word, learn it forever.

Consider the case of a hypothetical investor who purchases a small consumer goods company that is very popular in their local town. Although the company only had net assets of $1 million, the investor agreed to pay $1.2 million for the company, resulting in $200,000 of goodwill being reflected in the balance what is goodwill sheet. In explaining this decision, the investor could point to the strong brand and consumer following of the company as a key justification for the goodwill that they paid. If, however, the value of that brand were to decline, then they may need to write off some or all of that goodwill in the future.

It also attracts investors and encourages stakeholders to forgive you if you make a mistake. Goodwill doesn’t consider identifiable assets such as contracts, legal rights or assets that can be separated, divided, transferred https://www.bookstime.com/ or sold. Practice goodwill refers to the amount of goodwill specifically for practices, such as a law firm. Practice goodwill is similar to business goodwill as it considers the practice’s overall value.

How Does Company Goodwill Work?

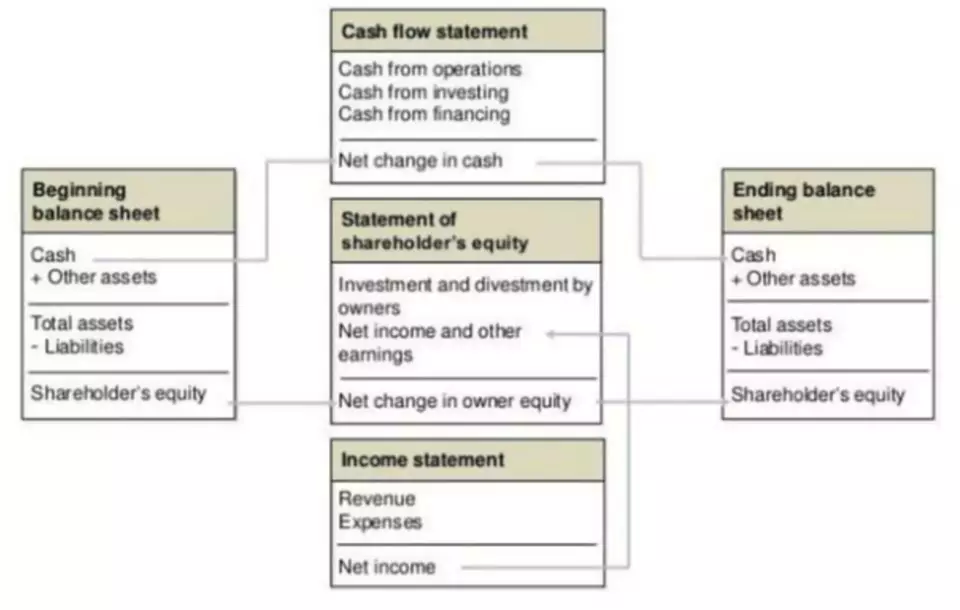

Even though goodwill is technically considered an asset, it is not always reported on thebalance sheet. Why not, because valuing a business is very subjective and can’t be measured easily or accurately. Companies assess whether an impairment exists by performing an impairment test on an intangible asset. Items included in goodwill are proprietary or intellectual property and brand recognition, which are not easily quantifiable. Helping private company owners and entrepreneurs sell their businesses on the right terms, at the right time and for maximum value. Goodwill is a saleable asset, presumed to generate sales revenue and customer continuity.

- Goodwill is an asset that does not depreciate, but its value fluctuates depending on the earnings of the firm, i.e., the value of the goodwill declines with a decline in the earnings.

- Peggy James is a CPA with over 9 years of experience in accounting and finance, including corporate, nonprofit, and personal finance environments.

- The GoCardless content team comprises a group of subject-matter experts in multiple fields from across GoCardless.

- This is due to the different assets and liabilities that go into the calculation.

- Goodwill needs to be valued when a triggering event results in the fair value of goodwill falling under the current book value.

First, get the book value of all assets on the target’s balance sheet. This includes current assets, non-current assets, fixed assets, and intangible assets.

goodwill Definitions and Synonyms

She most recently worked at Duke University and is the owner of Peggy James, CPA, PLLC, serving small businesses, nonprofits, solopreneurs, freelancers, and individuals. Depreciation is what happens when a business asset loses value over time.

While it contributes significantly to its success, the value of goodwill for a business can be hard to define as it doesn’t generate any cash flows for the business. There is also the risk that a previously successful company could face insolvency. When this happens, investors deduct goodwill from their determinations of residual equity. While normally this may not be a significant issue, it can become one when accountants look for ways to compare reported assets or net income between different companies . Goodwill is the value placed on the expectation that the clients or customers of an established company will continue to patronize it out of habit or confidence in the conduct of its business. The positive reputation of a business and its likely continued patronage by clients, considered as part of its market value.